28+ write off mortgage interest

Other closing costs are not. You may still be able to.

Aktualisiertes Pdf Dpg Tagungen

Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total taxable.

. Web Depending on how big your mortgage is you may encounter a cap on the interest you can deduct. Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could. Web Most homeowners can deduct all of their mortgage interest.

Web The date your home equity loan was signed could influence the deduction youre able to take. Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Increasing Mortgage Payments Could Help You Save on Interest.

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Ad Shortening your term could save you money over the life of your loan.

12 Tax Deductions That Have Disappeared. If your mortgage was in place on December 14 2017 you can. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Web Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes. Ad View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

State and local taxes have long been one of the largest write-offs for those who itemize. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. 15 2017 you can.

8 2022 at 144 pm. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000.

If you took out a home equity loan after Dec. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Mems Accelerometer Gyroscope And Imu Market I Micronews

The Home Mortgage Interest Deduction Lendingtree

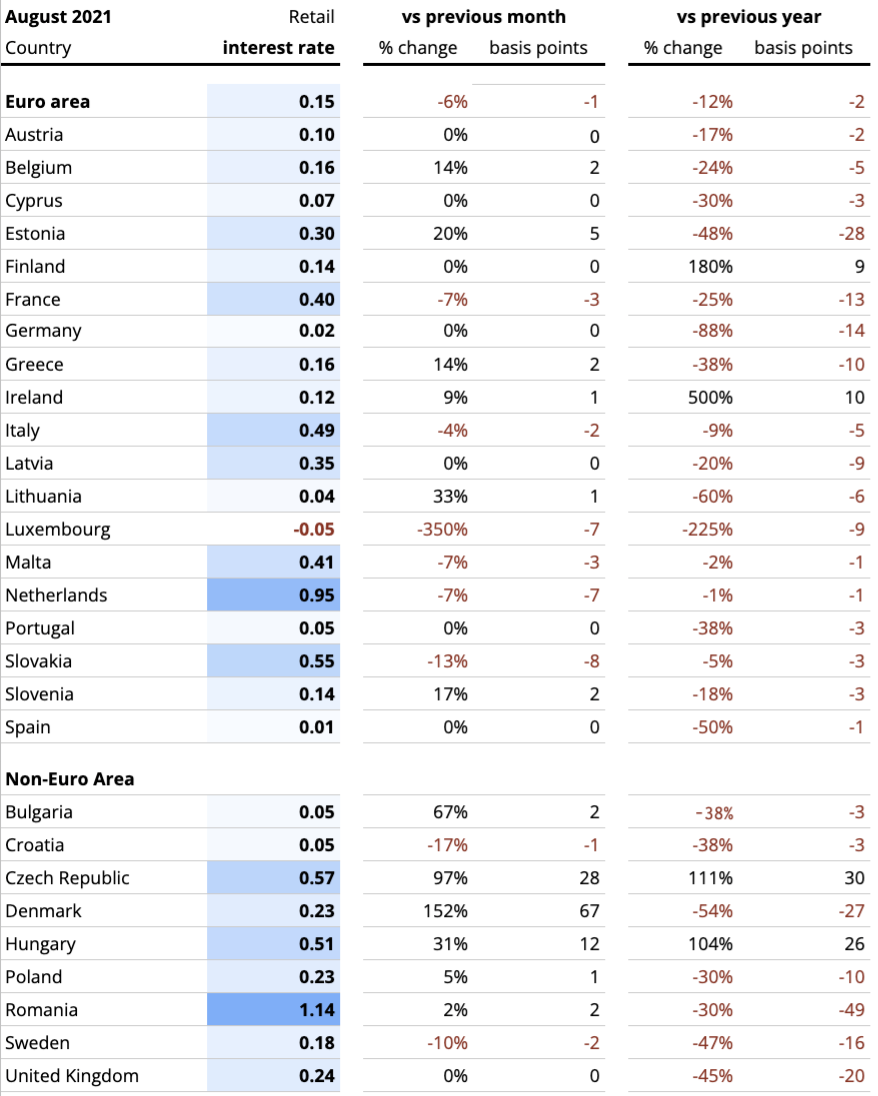

Interest Rates Explained By Raisin

Which States Benefit Most From The Home Mortgage Interest Deduction

56 Nassau Road Roosevelt Ny 11575 Mls 3372015 Howard Hanna

Interest Rates Explained By Raisin

Hr7762 00 Philips Food Processor Dedeman

28 Rate Sheet Templates Word Excel Pdf Document Download

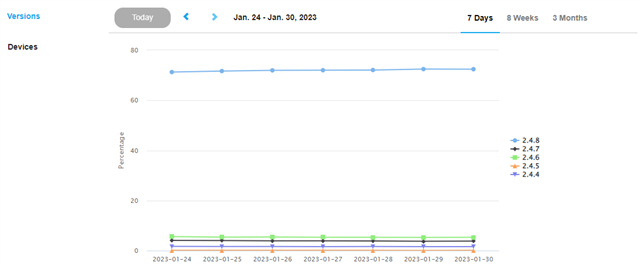

News Announcements Connect Iq Garmin Forums

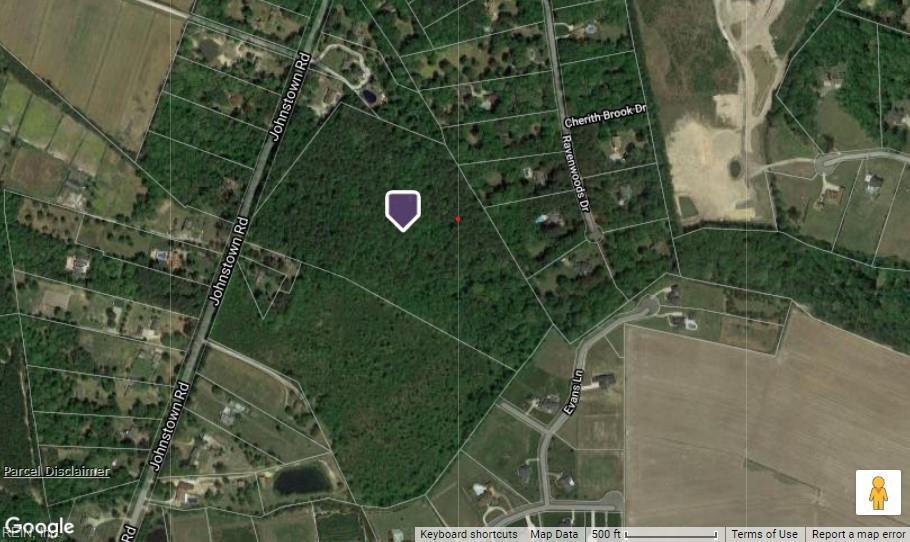

28 Ac Johnstown Rd Chesapeake Va 23322 Mls 10421385 Redfin

What Your Mortgage Interest Rate Really Means Money Under 30

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

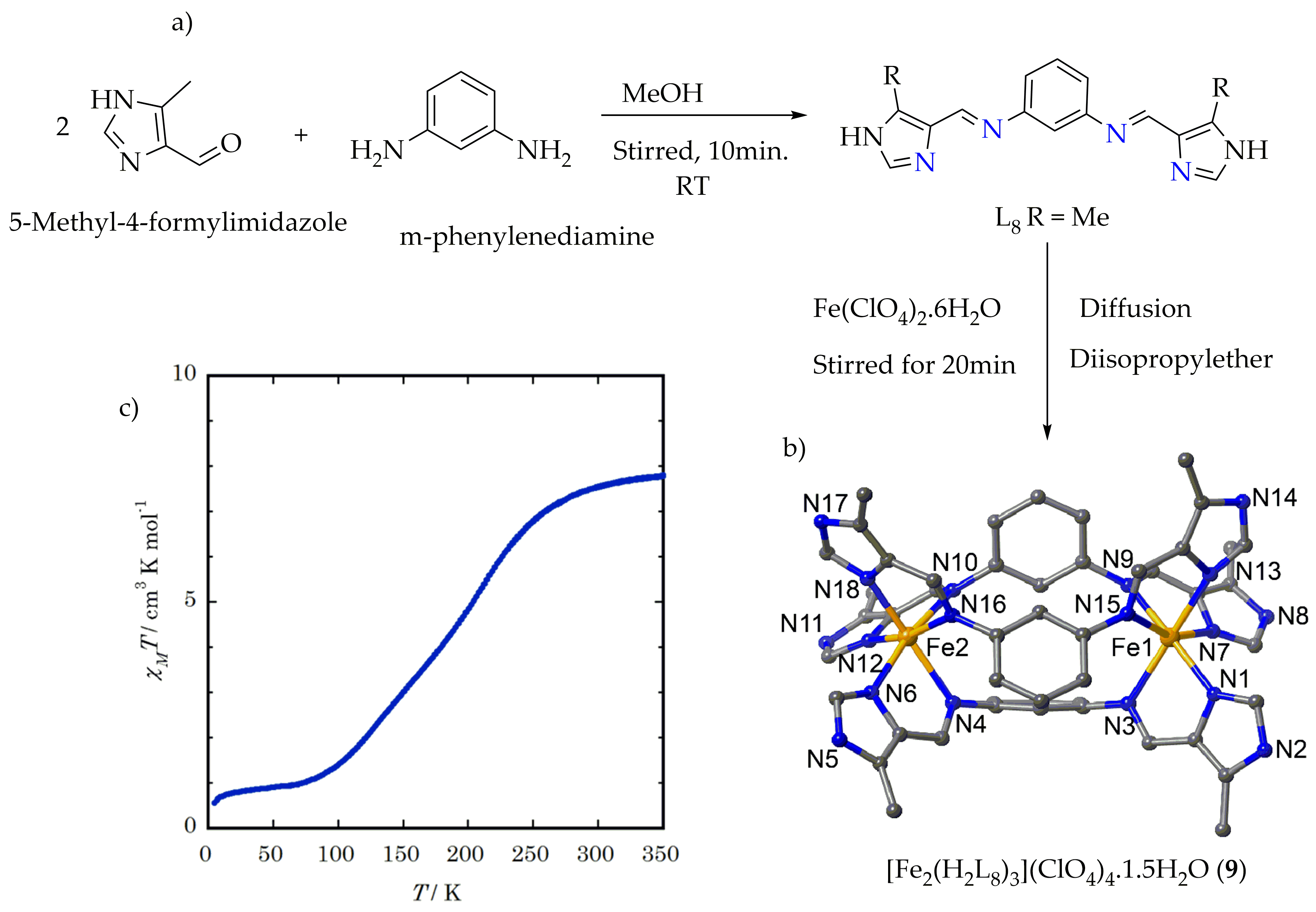

Molecules Free Full Text Iron Ii Mediated Supramolecular Architectures With Schiff Bases And Their Spin Crossover Properties

Yzxvtpc5aqjbsm

Chalet Martine Chalet Martine

Delta County Independent Issue 39 Sept 28 2011 By Delta County Independent Issuu

28 Business Ideas In Latur For 2023 Low Investment Needed